The Rally’s Backbone Just Got Stronger

- Christopher Garliss

- Nov 20, 2025

- 6 min read

The Rally’s Backbone Just Got Stronger

Nvidia’s earnings and guidance beat expectations.

That could trigger short covering across the broader tech sector.

Fed meeting minutes lean toward a dovish December pause.

Wall Street got a dose of conviction yesterday, and it came from the top…

Two important catalyst events took place yesterday afternoon. AI heavyweight Nvidia reported earnings, and the Federal Reserve released minutes from its October policy meeting. Both are significant, because, taken together, they go a long way toward easing Wall Street’s recent anxiety around AI demand and the Fed’s policy path.

Heading in, nerves were high. Investors feared Nvidia’s outlook might disappoint, especially with chatter about potential delays in high-end chip production. On the macro side, the worry was that the Fed might be walking back its easing bias, especially after recent comments from policymakers and a lack of fresh economic data.

But based on what I’ve read and heard, AI demand remains strong, and the Fed’s dovish stance hasn't changed. Both dynamics should help keep the S&P 500’s rally on track.

But don’t take my word for it, let’s look at what the data’s telling us…

Nvidia’s Earnings

Nvidia’s third-quarter results were a shot in the arm for AI bulls, and a clear rebuttal to bubble talk. The company posted record revenue of $57 billion, up 22% from last quarter and 62% year over year. It was the first sequential revenue acceleration in seven quarters, powered by unrelenting demand for data-center compute power. Gross margins hit a stunning 73.6% (non-GAAP), with guidance pointing even higher for the fourth quarter. In a market starved for pricing power, Nvidia’s ability to expand margins while scaling revenue shows just how tight the supply-demand dynamic remains.

CEO Jensen Huang didn’t duck the AI bubble narrative. He said, “From our vantage point, we see something very different.” He cited the shift from CPUs to GPUs, the monetization of AI through ads and agents, and the rise of new foundation model builders. He framed Nvidia as the backbone of a new computing era—one where training and inference are both compounding. In short, he sees a secular boom, not a speculative froth.

Backlog remains robust. Blackwell chips are “off the charts,” and cloud GPUs are sold out. Nvidia spotlighted new partnerships with OpenAI, Anthropic, and xAI, including a $100 billion infrastructure buildout with OpenAI and a deep tech pact with Anthropic. These aren’t just logos, they’re long-cycle commitments. The company also returned $37 billion to shareholders year-to-date and still has $62 billion left under its buyback authorization.

Looking ahead, Nvidia guided to $65 billion in fourth quarter revenue, with gross margins expected to tick up to 75%. That’s not just strong, it’s dominant. The company is caught in a virtuous cycle: stronger demand fuels more investment, which drives even more demand. For investors worried about saturation or slowdown, this quarter was a reminder that Nvidia isn’t just selling chips, it’s selling the picks and shovels of the AI gold rush.

Still, not everyone was convinced going in. Michael Burry had flagged concerns that hyperscalers were stretching “useful life” assumptions too far, potentially masking future replacement costs and inflating capital efficiency. Nvidia’s CFO Colette Kress pushed back, noting that GPU life cycles are indeed extending, as customers repurpose older chips for inference and lighter workloads.

That echoed recent comments from former Alphabet executive David Friedberg. Based on conversations with tech operators, Friedberg noted that 7- to 8-year-old GPUs are still running in data centers. His take: the depreciation curve may be flatter than skeptics think, and the installed base more resilient. In that light, Nvidia’s blowout quarter wasn’t just a beat, it was a rebuttal.

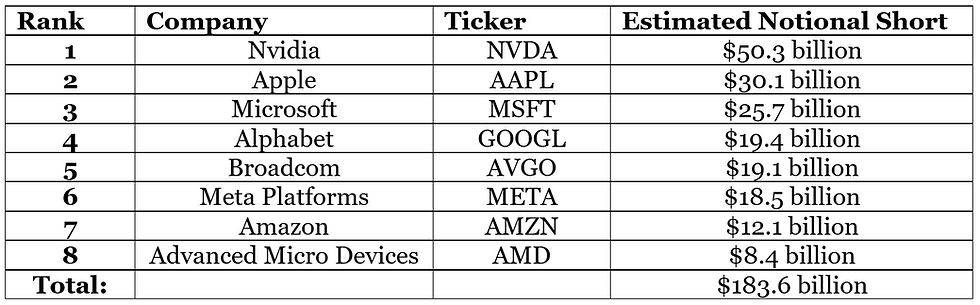

The results aren’t just likely to pull in buyers—they could trigger a short-covering rally across the tech complex. Notional short interest in these names is massive. And when you factor in liquidity and unwind risk, the setup gets even tighter.

Here’s the math behind it, using the formula:

Average Daily Volume × Closing Price × Days to Cover

Take Nvidia. Based on the latest Nasdaq data:

Average Daily Volume: 186.24 million shares

Closing Price: $186.52

Days to Cover: 1.45

Put it together:

186,240,000 × $186.52 × 1.45 = $50.3 billion

That’s the notional exposure of short positions in Nvidia alone. Add the rest, and you’re looking at nearly $184 billion in potential unwind pressure, concentrated in a handful of names that make up roughly 33% of the S&P 500. These stocks dominate the index by market cap and earnings power. When they move, the index moves with them.

The Fed Minutes

Ahead of the December 9–10 policy meeting, Wall Street had been questioning whether the Fed would stick to its easing bias. Back in September, the Summary of Economic Projections penciled in three rate cuts by year-end. But more recently, several voting members had suggested that the lack of fresh government data might justify holding steady.

That uncertainty had markets on edge. But yesterday’s minutes helped calm the waters.

Policymakers noted that “downside risks to employment rose in recent months,” citing slower job gains and a slight uptick in unemployment. Several participants saw underlying inflation, excluding tariff effects, as “close to the Committee’s target.” That gave the Fed room to ease without fearing an inflation flare-up.

Still, given the cuts at the September and October meetings, several members wanted to wait before moving again. They preferred to see more official labor data before acting.

But the key takeaway came in the longer-term outlook. A broad consensus of “most participants” judged that further downward adjustments would likely be appropriate “over time” as policy moves toward neutral. In other words, they’re open to cutting in December if needed, but would rather wait until early next year.

That points to a “dovish pause.” Wall Street may not get the December cut it's hoping for, but the tone will lean accommodative. That’s likely a better outcome than cutting now and sounding hawkish after.

Bringing It All Together

Between Nvidia’s blowout quarter and the Fed’s steady hand, two of the market’s biggest question marks just got clearer. AI demand is real. Policy support is still in play. And with nearly $184 billion in short exposure sitting on top of the most influential names in the S&P 500, the path of least resistance—at least for now—still points higher.

Five Stories Moving the Market:

Nvidia CEO Jensen Huang shrugged off concerns about an AI bubble as the company surprised Wall Street with accelerating growth after several quarters of slowing sales; the company said it expected fiscal fourth-quarter sales of $65 billion, plus or minus 2%, compared with analysts' average estimate of $61.66 billion – Reuters. (Why you should care – Jensen reiterated the company has $500 billion worth of backlog for its most advanced AI semiconductors)

Minutes of the October monetary policy meeting showed divisions over whether the Federal Reserve should cut interest rates next month, leaving a growing contingent of policymakers uncomfortable with a December rate reduction – WSJ. (Why you should care – the minutes of the meeting showed that officials still support additional rate cuts moving out into next year, even if it doesn’t happen in December)

U.S. President Donald Trump plans to roll out a “Genesis Mission” as part of an executive order next week at the White House to boost U.S. artificial intelligence efforts, according to Department of Energy Chief of Staff Carl Coe; the effort is intended to signal that the Trump administration sees the coming AI race as important as the Manhattan Project or space race – Bloomberg. (Why you should care - Coe said work on emerging AI technologies could involve more public/private partnerships)

U.S. officials are privately saying that they might not levy long-promised semiconductor tariffs soon, potentially delaying a centerpiece of President Donald Trump’s economic agenda; officials relayed these messages over the last several days to stakeholders in government and private industry – Reuters. (Why you should care – these statements could help to boost demand and ease concerns around rising costs)

The U.S. Bureau of Labor Statistics said it will not publish an October employment report and noted it will incorporate those payrolls figures into the November report set to be published in December; the BLS said October household data, which informs key statistics like the unemployment rate, could not be collected retroactively – Bloomberg. (Why you should care – the BLS said the blended October/November employment data will come out on December 16, after the Federal Reserve’s December 10 policy announcement)

Economic Calendar:

Earnings: CPRT, INTU, ROST, WMT

Japan – PPI for October

France – Unemployment Rate for 3Q (1:30 a.m.)

U.K. – GDP for Q3 (2:00 a.m.)

U.K. – Industrial, Manufacturing Production for September (2:00 a.m.)

U.K. – Exports, Imports for September (2:00 a.m.)

U.S. – IEA Monthly Report (4:00 a.m.)

Eurozone – ECB Economic Bulletin (4:00 a.m.)

Eurozone – ECOFIN Meetings (5:00 a.m.)

Eurozone – Industrial Production for September (5:00 a.m.)

Fed’s Daly (San Francisco, Non-voter) Speaks (8:00 a.m.)

U.S. - Initial Jobless Claims (8:30 a.m.)

U.S. - Continuing Claims (8:30 a.m.)

Treasury Auctions $19 Billion in 10-Year TIPS (1 p.m.)

Fed's Balance Sheet Update (4:30 p.m.)

Comments