Housing is Dismantling the Last Mile of Inflation

- Christopher Garliss

- 2 days ago

- 5 min read

Housing is Dismantling the Last Mile of Inflation

There were 1.2 million existing homes for sale in January.

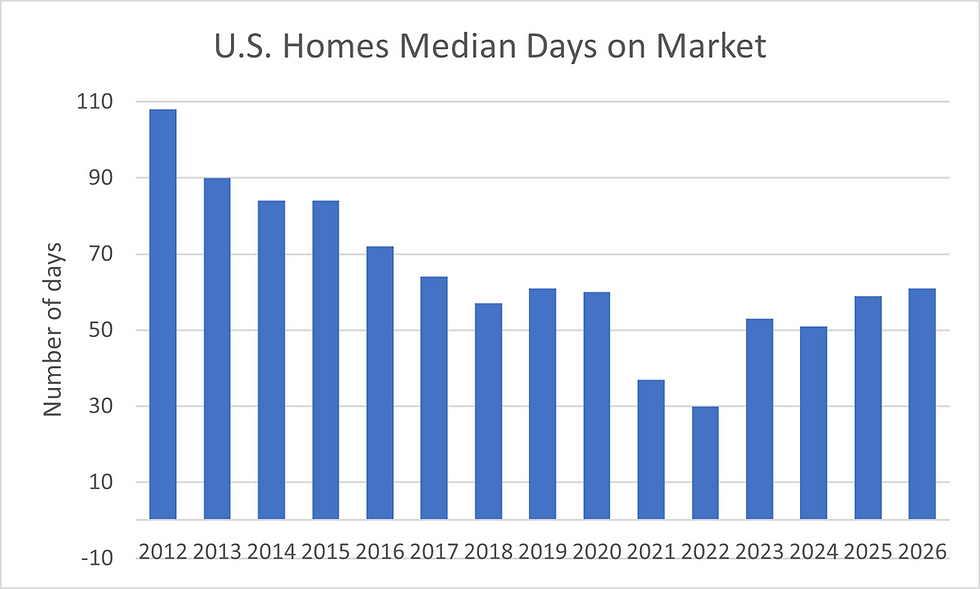

The number of days on the market keeps rising.

The median sales price declined over 8% since June’s peak.

Housing is doing what the Fed won’t: it’s crushing inflation in real time…

The start of this year has tested investors’ patience. Even with the Consumer Price Index (“CPI”) drifting closer to the Federal Reserve’s 2% target last week, policymakers show no interest in stepping off the sidelines. Their message has been remarkably consistent: they’re still uneasy about inflation growth, and they want to give last year’s rate cuts a chance to run their course. Historically, that transmission takes six to eight months. In their view, they can afford to wait—and they intend to.

What complicates the picture is what’s coming next. Our central bank could have a new chair by June, and leadership transitions tend to make the institution more cautious, not less. But the path isn’t locked in. If inflation continues to cool through the spring, it could shift the internal debate and reopen the door to additional easing. Wall Street still expects the next cut in June, but the stretch between now and then is where the real story will take shape.

And while markets obsess over the Fed’s next move, they’re missing a key signal hiding in plain sight: housing demand has stalled. Redfin reported that homes sat on the market for an average of 61 days in January. That was longer than December’s 60 days, longer than 2025’s 59 days, and the slowest turnover since 2017, when the average was 64. That’s not a blip; it’s a cooling trend…

The National Association of Realtors (“NAR”) underscored the same point last week. Existing home sales fell to an annualized pace of 3.9 million in January, the slowest since September 2024 and still hovering near the bottom of a multi‑year range. Meanwhile, inventory has climbed back toward pre‑pandemic norms. More supply plus softer demand is pressuring prices. Lower home prices feed directly into slower inflation, giving the Fed more room to ease later this year. That easing cushion is one of the quiet forces that should support a steady rally in the S&P 500 as 2026 unfolds.

But don’t take my word for it, let’s look at what the data is telling us…

Each month, NAR releases its housing indicators. Existing home sales make up 85–90% of total volume, so they’re a key gauge of market health. In January, the months’ supply—an indicator representing the duration required to sell all listed homes—rebounded to 3.8. That compares to the 3.3 reading in December. Bear in mind, supply tends to remain weak during the winter. That’s likely because sellers pull their listings. Even so, the figure is higher than last year’s 3.4‑month total and indicates a steady rebound from the pandemic lows...

NAR’s time‑on‑market numbers matched Redfin’s trend. Properties lingered for 78 days in January, up from 73 in December and a year earlier. That’s a sign buyers are taking their time.

And prices? They’re declining. Realtor.com says the median listing price per square foot was $220 again in January, off 2% year‑over‑year. That’s the fifth straight month of annualized decline. We haven’t seen back‑to‑back months of annualized declines since mid‑2023. Put another way, sellers are feeling less confident about their ability to command a premium.

Sale prices tell the same story. NAR reports the median price of an existing home sold in January was just over $396,800, unchanged versus last year. But that’s down 2% compared with December and was weaker than typical seasonality since 2018. January marked the tenth straight month of annualized growth at 2% or less. The last similar stretch was mid‑2023. In other words, the housing market hasn’t looked this soft since the Fed was still hiking.

Bottom line: inventory is doing exactly what it always does in a soft market—it’s putting a ceiling on prices. A shaky job market and a Fed that refuses to rush into more easing are keeping would‑be buyers on the sidelines. And with most homeowners far more inclined to refinance than uproot, sales could stay sluggish for a while.

Housing carries real weight in the inflation math. It makes up roughly 35% of CPI and about 17% of the Personal Consumption Expenditures (“PCE”) index. When home prices cool, rental pricing power tends to follow. That pulls down owners’ equivalent rent, one of the most influential components in both CPI and PCE.

Elevated supply should help keep that pressure moving in the right direction, taming inflation over the next few months and improving the odds of additional rate cuts. That easing cushion is a quiet but meaningful tailwind for a steady S&P 500 rally as the year unfolds.

Five Stories Moving the Market:

Japan's economy limped back to meagre growth in the fourth quarter, significantly missing market expectations in a key test for Prime Minister Sanae Takaichi's government as cost-of-living pressures drag on confidence and domestic demand – Reuters. (Why you should care – that’s likely to drive the government to introduce more economic stimulus while potentially placing the Bank of Japan’s rate hikes on hold)

After holding the line on prices for several months, companies have begun a new round of increases, in some cases by high-single-digit percentage points; the Adobe Digital Price Index found that online prices posted their largest monthly increase in a dozen years in January – WSJ. (Why you should care – despite the article’s report of January price increases, the pace of annualized CPI growth still cooled last month)

U.S. Secretary of State Marco Rubio gave a message of unity to Europeans, saying Washington does not intend to abandon the transatlantic alliance, but that Europe's leaders had made a number of policy mistakes and need to change course – Bloomberg. (Why you should care – Rubio said the success of the two regions is intertwined but they must be an alliance capable and ready to fight for what’s important)

The Pentagon is "close" to cutting business ties with Anthropic and designating the AI company a "supply chain risk" — meaning anyone who wants to do business with the U.S. military has to cut ties with the company – Reuters. (Why you should care – such a designation could inhibit the use of its Claude product by enterprise customers)

The vital signs of the American economy are pointing in the same, favorable direction more convincingly than at any point since before the pandemic; inflation is falling, the labor market is holding, and growth has been solid - WSJ. (Why you should care – follow through on these trends could lead to easier monetary policy later this year)

Economic Calendar:

Markets are closed in China and South Korea

Earnings: CDNS, DVN, EQT, FE, MDT, PANW, RSG, SUN, TOL, VMC

RBA Meeting Minutes

U.K. – Average Earnings Index for December (2 a.m.)

U.K. – Employment Change for December (2 a.m.)

Eurozone – ZEW Economic Sentiment for February (5 a.m.)

U.S. – ADP Employment Change Weekly (8:15 a.m.)

U.S. – NY Fed Manufacturing Index for February (8:30 a.m.)

Canada – CPI for January (8:30 a.m.)

U.S. – Conference Board Employment Trends Index for January (10 a.m.)

U.S. – NAHB Housing Market Index for February (10 a.m.)

Treasury Auctions $89 Billion in 13-Week Bills (11:30 a.m.)

Treasury Auctions $77 Billion in 26-Week Bills (11:30 a.m.)

Treasury Auctions $90 Billion in 6-Week Bills (1 p.m.)

Treasury Auctions $50 Billion in 52-Week Bills (1 p.m.)

Fed’s Barr (Board Member, Voter) Speaks (12:45 p.m.)

Fed’s Daly (San Francisco, Non-Voter) Speaks (2:30 p.m.)

Comments