Despite the Noise, Inflation Expectations Remain Anchored

- Christopher Garliss

- 15 hours ago

- 5 min read

NY Fed one-year inflation expectations were 3.1%.

The three- and five-year expectations held steady at 3%.

The numbers remain in line with their historical figures.

The crisis narrative is loud, but the inflation story is quietly stabilizing…

The financial media never misses a chance to sell fear. Give them a shadow on the wall and they’ll frame it as a monster. They understand the game: humans are hard‑wired to lock onto threats, even imagined ones. It’s an evolutionary reflex that still governs our attention. So, when someone mutters “crash,” “bubble,” or “the next big reckoning,” the headlines multiply. And most of the time, that’s all they are—headlines chasing adrenaline.

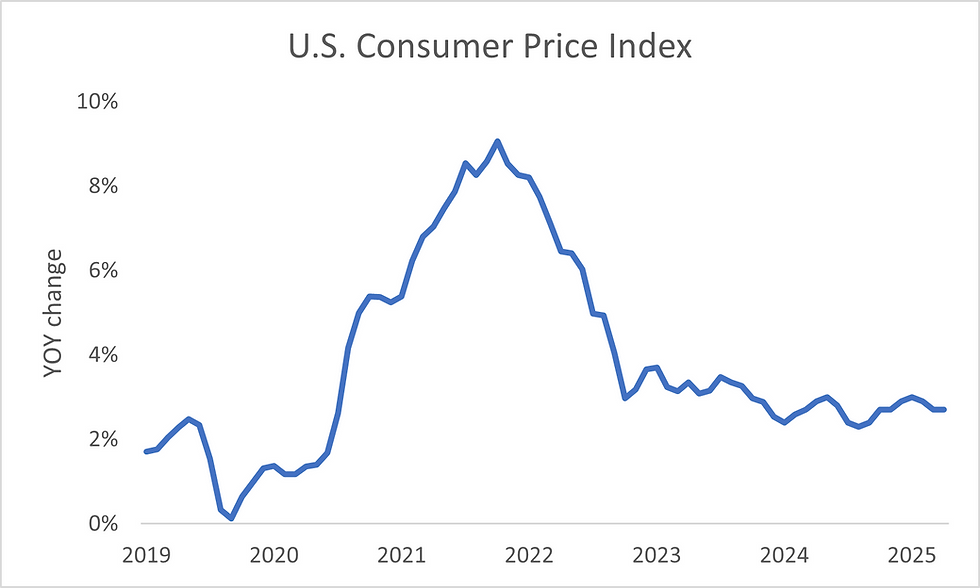

Inflation has been one of their favorite levers. When the Federal Reserve had to jack up interest rates to rein in runaway prices a few years back, the market sank. Ever since, even as inflation has cooled, CNBC, the Wall Street Journal, and Bloomberg have kept warning that another spike is lurking just out of sight. The data keeps easing, but the narrative keeps insisting the danger is circling.

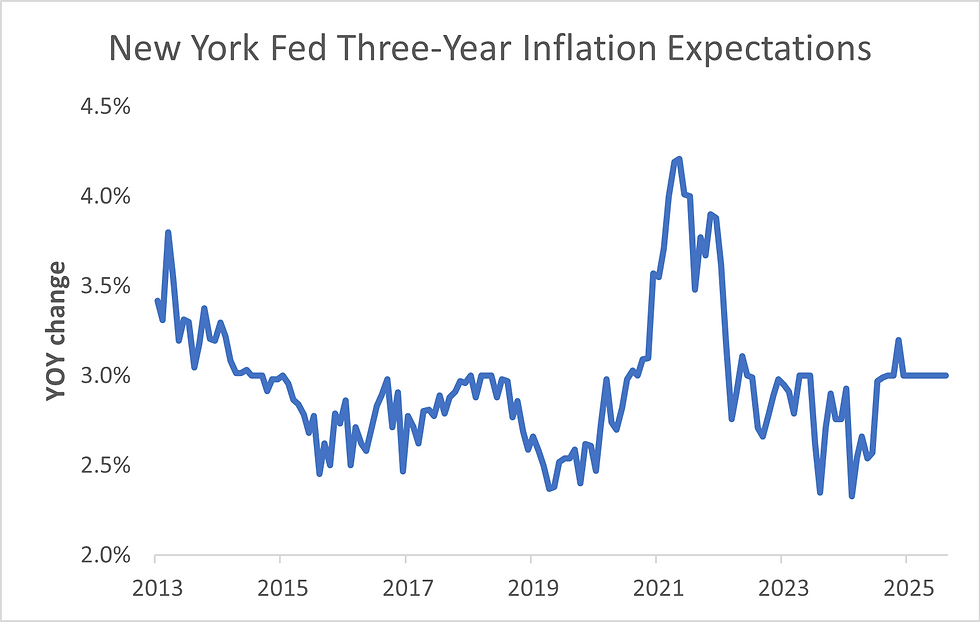

Yesterday brought another data point that reinforces that cooling trend. The New York Fed’s January survey showed inflation expectations, both near- and long‑term, haven’t moved. They’re sitting right in line with the survey’s historical norms. That matters because the Fed wants to avoid a scenario where households start buying early out of fear of higher prices ahead. That kind of behavior can create the very inflation spiral policymakers are trying to prevent.

If expectations stay anchored, as this latest reading suggests, the Fed should have plenty of room to keep trimming interest rates later this year. And that backdrop supports a steady, durable rally in the S&P 500 Index.

But don’t take my word for it, let’s look at what the data’s telling us…

Yesterday, the New York Fed released its Survey of Consumer Expectations for January. It summarizes information gathered from 1,300 households about their outlook on inflation, household finances, and the labor and housing markets. The survey rotates respondents in and out to keep results fresh.

The survey gives policymakers a window into how people think, and how they’re likely to behave. These readings matter because they reveal whether households expect inflation to keep climbing or drift back toward normal. And based on the latest results, near‑term expectations eased in January…

Inflation expectations for the next 12 months slipped to 3.1%, down from 3.4% in December. For context, the New York Fed’s records going back to 2013 show this gauge averaging just above 3.3%. You can see the arc: expectations spiked in 2021 and 2022 as prices surged, then settled back toward 3% once the pandemic stimulus faded. After a few bumps early in 2025, the measure looks steady again. That’s calmer than the headlines would have you believe.

The longer‑term picture carries the same quiet message. Consumers aren’t bracing for a new wave of price growth. The three‑year inflation expectation held firm at 3% in January, right in line with the survey’s historical norm. No drift. No panic. No sign of the runaway narrative the media keeps trying to resurrect…

If we move out to five years, we can see that inflation expectations were the same last month as they were for the prior four, holding at 3%. That’s in line with the longer-term average, based on data going back to early 2022…

As I noted at the start, the Fed is watching these numbers like a pressure gauge. Policymakers want to know exactly how much support they can still pump into the economy without reigniting the kind of long‑term inflation surge we saw in 2021. We’ve had a few bumps along the way, but nothing that resembles a repeat episode. Not according to the New York Fed’s latest read.

The December CPI print showed annual price growth at 2.7%. That’s still above the Fed’s 2% target but drifting lower. And if the Cleveland Fed’s estimate for January holds, the annualized pace could cool to 2.4%. That’s the kind of incremental easing that gives policymakers breathing room.

Which is why the New York Fed’s expectations data becomes the real tell. If households stay anchored—and so far, they are—the Fed has room to keep supporting economic expansion. And if Chair Jerome Powell signals growing confidence in the inflation outlook, that backdrop should help sustain a steady, durable rally in the S&P 500.

Five Stories Moving the Market:

The Trump administration wants some of the world’s largest technology companies to publicly commit to a new compact governing the rapid expansion of AI data centers; the White House wants commitments designed to ensure energy-hungry data centers do not raise household electricity prices, strain water supplies or undermine grid reliability - Politico. (Why you should care – the pact seeks to ensure that companies boosting electricity demand will bear the cost of building new infrastructure)

Google parent Alphabet is set to raise $20 billion from a U.S. dollar bond offering — more than the $15 billion initially expected — and is also pitching investors on what would be its first ever offerings in Switzerland and the U.K.; the latter would include a rare sale of 100-year bonds – Bloomberg. (Why you should care - the U.S. dollar bond offering has drawn more than $100 billion in demand, causing the premium over Treasurys to shrink)

White House economic adviser Kevin Hassett said that U.S. job gains could be lower in the coming months due to slower labor force growth and higher productivity – Reuters. (Why you should care – Hassett is signaling the White House doesn’t anticipate a near-term labor market rebound)

The White House is at loggerheads with Congress over one of President Trump’s signature housing proposals, a ban on Wall Street investors buying single-family homes; lawmakers in both chambers have resisted supporting the investor ban, which traditional free-market advocates, Wall Street executives and the home-builder industry generally oppose – WSJ. (Why you should care – banning investors from buying swaths of houses could damage a pillar of housing market support since the financial crisis)

The European Central Bank is striving to ensure inflation remains under control as part of efforts to fortify the continent’s economy, President Christine Lagarde said, urging lawmakers to follow through on a list of necessary reforms – Bloomberg. (Why you should care – Lagarde called on leaders to boost innovation and simplify laws in an effort to support economic growth)

Economic Calendar:

Earnings – AIG, AZN, BP, CVS, DUK, FISV, GILD, KO, MAR, NET, SPOT, WMB

U.S. – NFIB Small Business Optimism for January (6:00 a.m.)

U.S. – ADP Employment Change Weekly (8:15 a.m.)

U.S. – Employment Cost Index, Wages for Q4 (8:30 a.m.)

U.S. – Export, Import Price Index for December (8:30 a.m.)

U.S. – Retail Sales for December (8:30 a.m.)

U.S. – Business Inventories for November (10:00 a.m.)

Treasury Auctions $90 Billion in 6-Week Bills (11:30 a.m.)

Treasury Auctions $58 Billion in 3-Year Notes (1 p.m.)

U.S. - American Petroleum Institute Crude Oil Inventory Data (4:30 p.m.)

Comments